Add a Standard Letter to an Open Return

Standard letters may be automatically added to returns upon creation or manually added one at a time.

To add all Client Letters to a return at once, right-click the tab for the signature form (1040, 1065, 1120, etc.) and select Add All Client Letters. To add all State Letters, right-click the tab for the signature state form, and select Add All Client Letters.

If a client letter is already attached to the open return, Add All Client Letters will not be available.

To manually add a single Standard Letter to an open return:

- With the return open, click the Forms menu; then, select Client Letter.

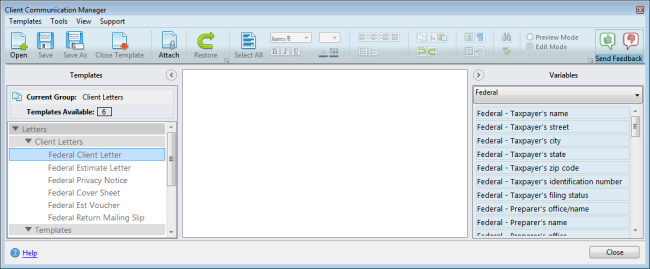

Client Communication Manager

- Under Client Letters (in the left pane), select the letter you wish to add to the open return.

- Do one of the following:

- Click the Open button on the toolbar.

- Double-click the selected letter.

- Click the Templates menu; then, select Open.

The selected letter will then appear in the middle pane.

- Edit the letter as desired.

Edits made this way will be saved globally. This means that the edited template, when added to any future returns, will contain the changes that were saved. Thus, it is strongly recommended to only make generic edits that are not specific to any particular taxpayer. If you would like to make changes to letters on a per return basis, skip steps 4 and 5 and attach the template as is. See Modifying Standard Letters for specific instructions on editing letters locally (per return).

- After editing, do one of the following:

- Click the Save button on the toolbar.

- Click the Templates menu; then, select Save.

- Press CTRL+S.

- Do one of the following:

- Click the Attach Template button on the toolbar.

- Click the Tools menu; then, select Attach Letter(s) to Return.

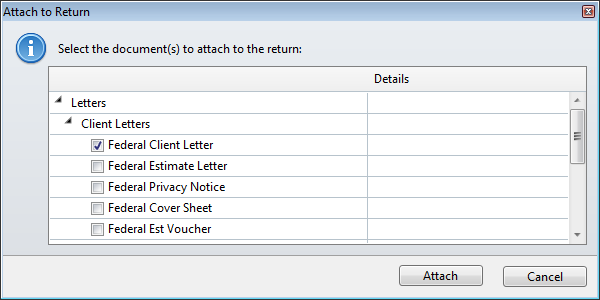

Attach to Return dialog box

- Select the check box(es) for the Client Letter(s) and/or Template(s) you would like to attach to the open return.

- Click Attach.

The selected Letters/Templates are attached to the open return and the Client Communication Manager regains focus.

- Close the Client Communication Manager when finished.

Custom Letters may also be added manually instead of or in addition to Standard Client Letters. See Client Letter Templates.

See Also: